Taxes 2025 Standard Deduction Over 65

Taxes 2025 Standard Deduction Over 65. The 2025 standard deduction amounts are as follows: If you’re a single filer or head of household age 65 and over, you get an extra boost to your standard deduction.

Most taxpayers take the standard deduction instead of itemizing, as it simplifies the filing. Seniors over age 65 may claim an additional standard deduction of $2,000 for single filers and $1,600 for joint filers.

Standard Deduction For 2025 Over 65 Justina P. Bird, Seniors over 65 can benefit from additional tax breaks beyond the extra standard deduction.

Standard Tax Deduction 2025 Married Over 65 Elena Quinn, In this article, we'll look into what the standard deduction entails for individuals over 65 in 2025 and 2025, how it differs from standard deductions for younger taxpayers, and.

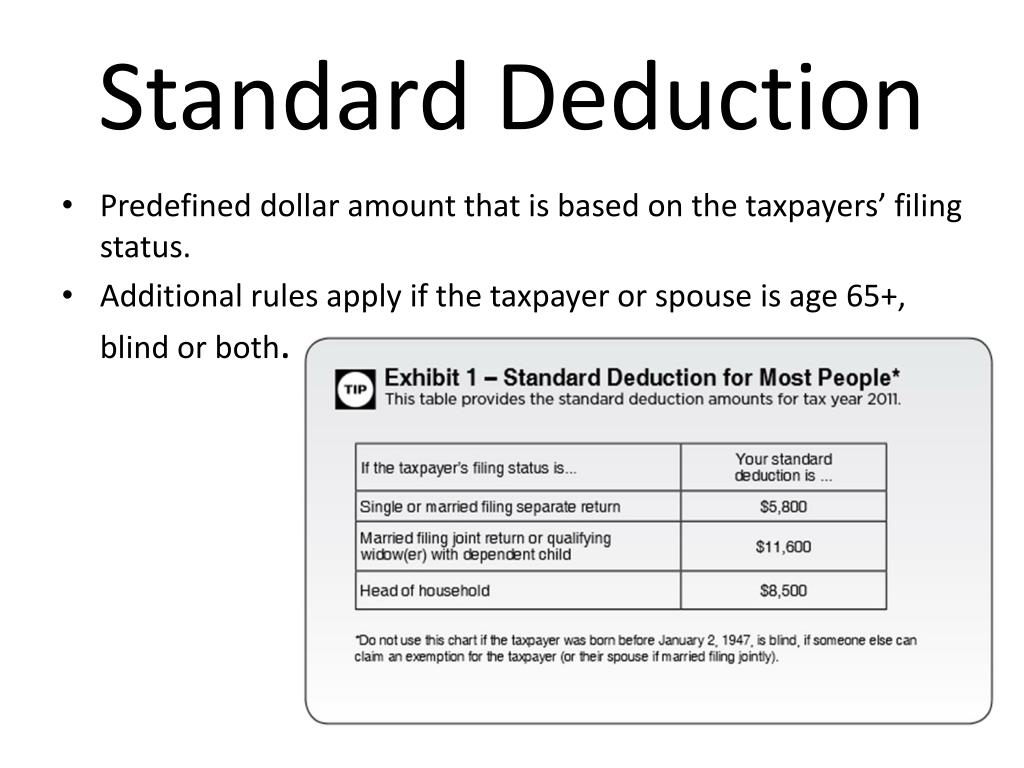

2025 Tax Calculator Canada Rowan Khadija, The standard deduction is a fixed dollar amount that reduces the amount of income subject to federal tax.

2025 Standard Tax Deduction For Seniors Zayne Hope, Most taxpayers take the standard deduction instead of itemizing, as it simplifies the filing.

2025 Standard Deduction For Seniors Over 65 Over 65 Eloisa Shaylah, 22, 2025, the irs announced the annual inflation adjustments for 2025.

2025 Tax Tables Married Filing Jointly Standard Deduction Lilia Cathleen, Seniors over 65 can benefit from additional tax breaks beyond the extra standard deduction.

Standard Deduction 2025 Irs 2025 Zahira Jade, One common question that arises is whether individuals over 65 are eligible for a higher standard deduction when filing their taxes in 2025 and 2025.

Irs 2025 Standard Deduction For Seniors Amani Jade, Seniors over age 65 may claim an additional.

Additional Standard Deduction For Over 65 2025 Aimil Auberta, 2025 standard deduction over age 65 there's an additional standard deduction for taxpayers 65 and older and those who are blind.