2025 Standard Deduction Single

2025 Standard Deduction Single. For 2025, the deduction is worth: The average income tax rate in 2025 was 14.9 percent.

And have until october 15, 2025 to finish and file your new york tax return. People 65 or older may be eligible for.

Federal Standard Deduction 2025 Audrye Jacqueline, The 2025 standard deduction for tax returns filed in 2025 is $13,850 for single filers, $27,700 for joint filers or $20,800 for heads of household. The 2025 standard deduction amounts are as follows:

Standard Deduction 2025 Age 65 Standard Deduction 2025, It has climbed steadily since the standard deduction. 2025 2025 estate and trust tax brackets.

IRS Notice CP91 What It Is And How To Respond Choice Tax Relief, The 2025 standard deduction was raised to $14,600. The amount of the standard deduction is adjusted every year to account for inflation.

2025 Taxes for Retirees Explained Cardinal Guide, The standard deduction amounts increase for the 2025 tax year — which you will file in 2025. Here are the standard deduction amounts set by the irs:

The IRS Just Announced 2025 Tax Changes!, They're discussing the possibility of adding an additional $2,000 for single filers,. The 2025 standard deduction amounts are as follows:

Standard Deductions for 20232024 Taxes Single, Married, Over 65, The amount of the standard deduction is adjusted every year to account for inflation. For the 2025 tax year, there's talk about making the standard deduction bigger.

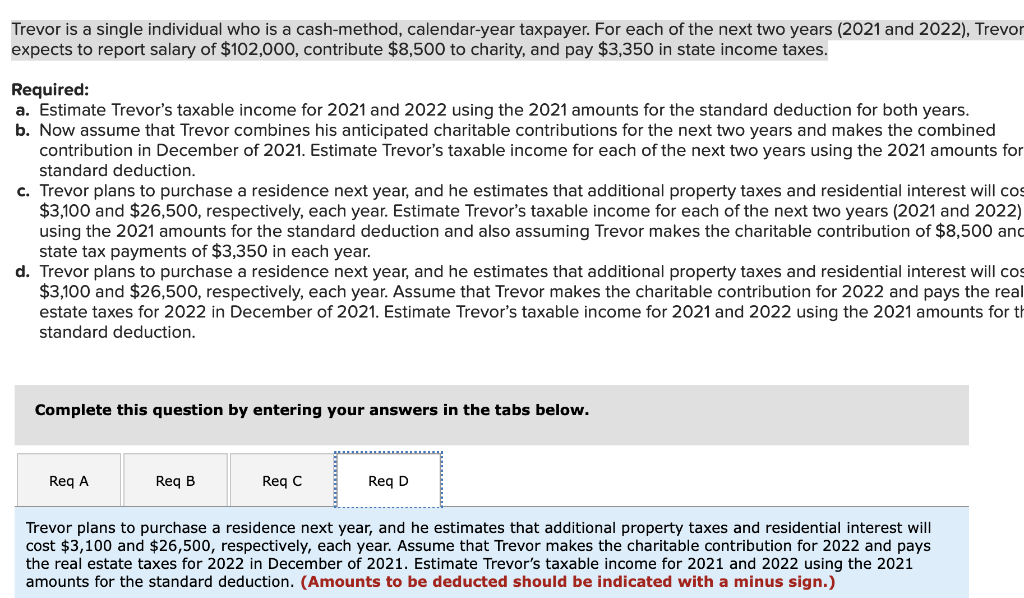

Solved Trevor is a single individual who is a cashmethod,, The standard deduction for single. Your standard deduction consists of the sum of the basic standard.

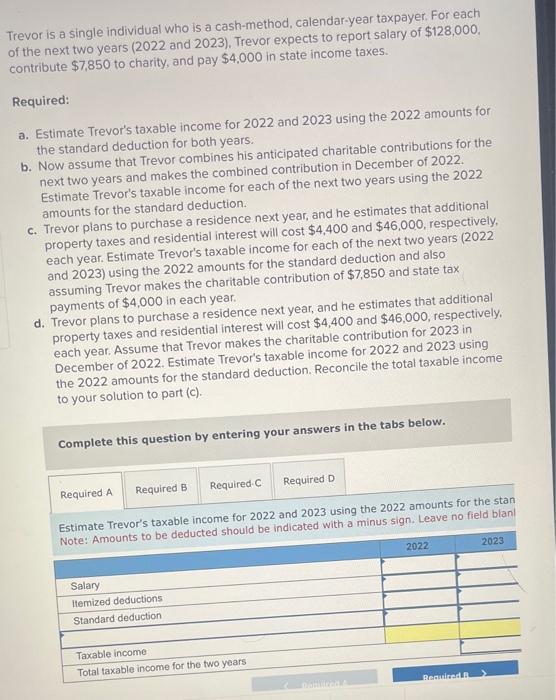

Solved Trevor is a single individual who is a cashmethod,, For taxpayers who are married and filing jointly, the standard deduction for the 2025 tax year. Individuals aged 65 or older may be eligible for additional.

How much do Isagenix essential oils cost compared to doterra oils and, And have until october 15, 2025 to finish and file your new york tax return. The standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, The standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. The 2025 standard deduction amounts are as follows: